Currencies used to be an exciting part of travelling. Arranging travel money with your bank or travel agent was part of the glamour once associated with leaving the country for holidays abroad. Today, with the advent of no-frills airlines, online currency brokers and prepaid currency cards, that glamour is gone, and any foreign exchange transaction can be carried out from the comfort of your sofa.

Moving yourself and/or your family from one country to another can be quite another matter.

Even returning to the UK after time spent living and/or working overseas can involve complex questions: what to do with foreign assets, how to handle investments booked in offshore locations, how to service foreign currency loans or mortgages, and how to meet foreign tax liabilities.

International moves generally require thought and planning well ahead of time. Where this involves leaving behind financial interests in foreign countries, with their associated currency exposure and foreign denominated liabilities, or returning to a country where you lived previously, there are difficult decisions to be made about how and in what currency to hold assets and investments.

Whether you’re a seasoned expatriate, a returning citizen, or first-time investor abroad, international financial planning is essential for your financial wellbeing. Even when settled, planning future currency use, and retaining access to currencies matching cashflow needs, can save you any unforeseen increases in costs, caused by large and unexpected foreign exchange movements.

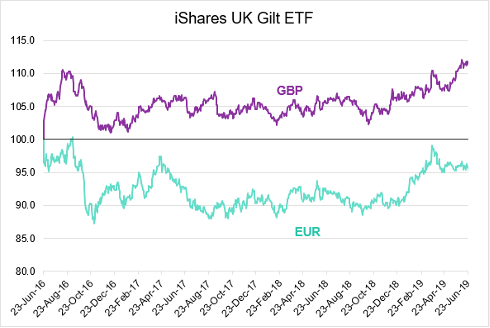

For example, a UK individual owning a holiday home in Europe will likely have ongoing expenses and liabilities denominated in EUR. If they only hold GBP investments, whilst they may be successful in GBP terms, they may be loss-making in EUR terms. To illustrate, whilst investing in UK government bonds might be considered a cautious investment strategy, the EUR value of those bonds after the Brexit vote would have fallen markedly and so might not support EUR expenditure. In effect, EUR expenses increased in GBP terms by at least 10% and have not since recovered.

Source: FactSet, Total returns in GBP and EUR

Additionally, if you are resident in the UK but not domiciled here, you may have the option of holding your investments outside of the UK in their original currency. This allows you to benefit from the remittance basis of taxation and match overseas liabilities with investment returns. If you have expenditures in different currencies, this can lead to savings on FX transactions and ensure that liabilities are kept in check despite large fluctuations in currency values.

At Partners Wealth Management, we understand the intricacies of international financial planning. We are familiar with the issues facing expats coming to live in the UK, even temporarily. As well as working with non-UK citizens moving to the UK, we regularly assist UK citizens returning home and those leaving the UK to live and work abroad. This extends to planning overseas property purchases and anticipating ongoing currency needs. Our cash flow modelling can be instrumental in showing the benefits of segregating assets (in the right currency) to meet specified expenses, within overall financial planning. We also work together with accountants and lawyers who are familiar with the international tax landscape, to provide tailored tax advice according to each client’s specific circumstances.

It might seem to be easiest when moving to the UK to leave existing assets where they are, assuming the asset/investment continues to meet the individuals’ requirements. Sometime this is suitable, but consideration of the tax impacts also needs to be factored in, especially in light of the proposed changes to “non-domiciled” tax rules in the UK. Generally, a suitable solution can be found that matches the required jurisdiction, currency and investment requirements but the physical assets or ownership structure may need to be amended to optimise the tax efficiency. In all of these circumstances appropriate advice should be sought to ensure that any planning is robust and avoids any adverse and costly obstacles.

Whether you are a US expat with investments in USD, or a European UK resident with EUR denominated investments abroad, our award-winning methodology helps identify the correct investment manager with the right investment solution and booking centre for your circumstances. Our independent investment service identifies investment managers who are highly specialised and well-versed in running investment portfolios and loans in a range of different currencies, including USD, EUR, CHF and others. They bring with them a wealth of knowledge in investment management and currency exposure optimisation, reporting to you (and correctly accounting for tax) in any number of currencies.

Our investment independence and research process enable us to identify suitable booking centres, products providers and investment managers to meet your regional and currency requirements. For example, the right UK pension provider can even hold and make payments in various currencies.

If you would like further information regarding any of the points raised in this article, please get in touch with a member of the International Team, your usual Partners Wealth Management adviser, or contact us on 020 7444 4030 or by email.

Erez Erlbaum

Erez Erlbaum

Partner

020 8051 9451

erez@partnerswealthmanagement.co.uk

Adrien Landreau

Adrien Landreau

Partner

020 8051 9452

alandreau@partnerswealthmanagement.co.uk

Partners Wealth Management does not provide tax, legal or accounting advice. It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission. Taxation is based on your individual circumstances and may be subject to change.