Following weeks of frantic criteria changes, it feels as though the mortgage market is pausing a little and maybe starting to look for the new normal. Whilst a lot has been happening the key news is that the Bank of England (BOE) Monetary Policy committee have kept the base rate at 0.10% pa, whilst the overall mortgage market remains competitive. Having considered what is available, we consider that there are some remaining schemes which are worth noting, which are:

- 2 year fixed at 60% LTV – 1.19% pa, with a lender’s arrangement fee of £995.

- 5 year Fixed at 60% LTV – 1.44%pa with a lender’s arrangement fee of £995

- Buy-to-let 2 year fixed rate at 60% LTV 1.29%pa with a lender’s arrangement fee of £1,995

*LTV = loan to value

Those lenders that had initial knee jerk reactions and ceased lending are now returning to the marketplace and those who remained, but cut their lending limits, are now slowly but surely maintaining the equilibrium. This means that there are options open to borrowers that are worth exploring.

The main obstacle to lending over the past weeks had been where a valuation visit had been required, however, with immediate effect, the Government has lifted this restriction and many lenders have already starting booking in valuation appointments. A word of caution, they have huge backlogs and lenders, in the interim, will continue to carry out remote valuations where possible.

Whilst the restrictions and back logs will cause delays to new purchase and re-mortgage applications, the Product Transfer (existing borrowers where their current rates are due to expire) is flourishing with many lenders offering market leading rates. Therefore, there are few reasons why clients should suffer high standard variable rates when there are options for them to consider.

It is viewed that the post-coronavirus world will bring many questions and challenges for the mortgage sector. At PWM we are embracing technology to efficiently and effectively manage our existing clients and advise new clients on the best options for their mortgage needs.

The above content does not represent a personal recommendation. If you have any questions on the buy-to-let sector reforms, rates or the mortgage market in general, our mortgage team is here to help. Please contact the team on 020 7444 4030 or by email.

Your home is at risk of repossession if you do not maintain mortgage payments.

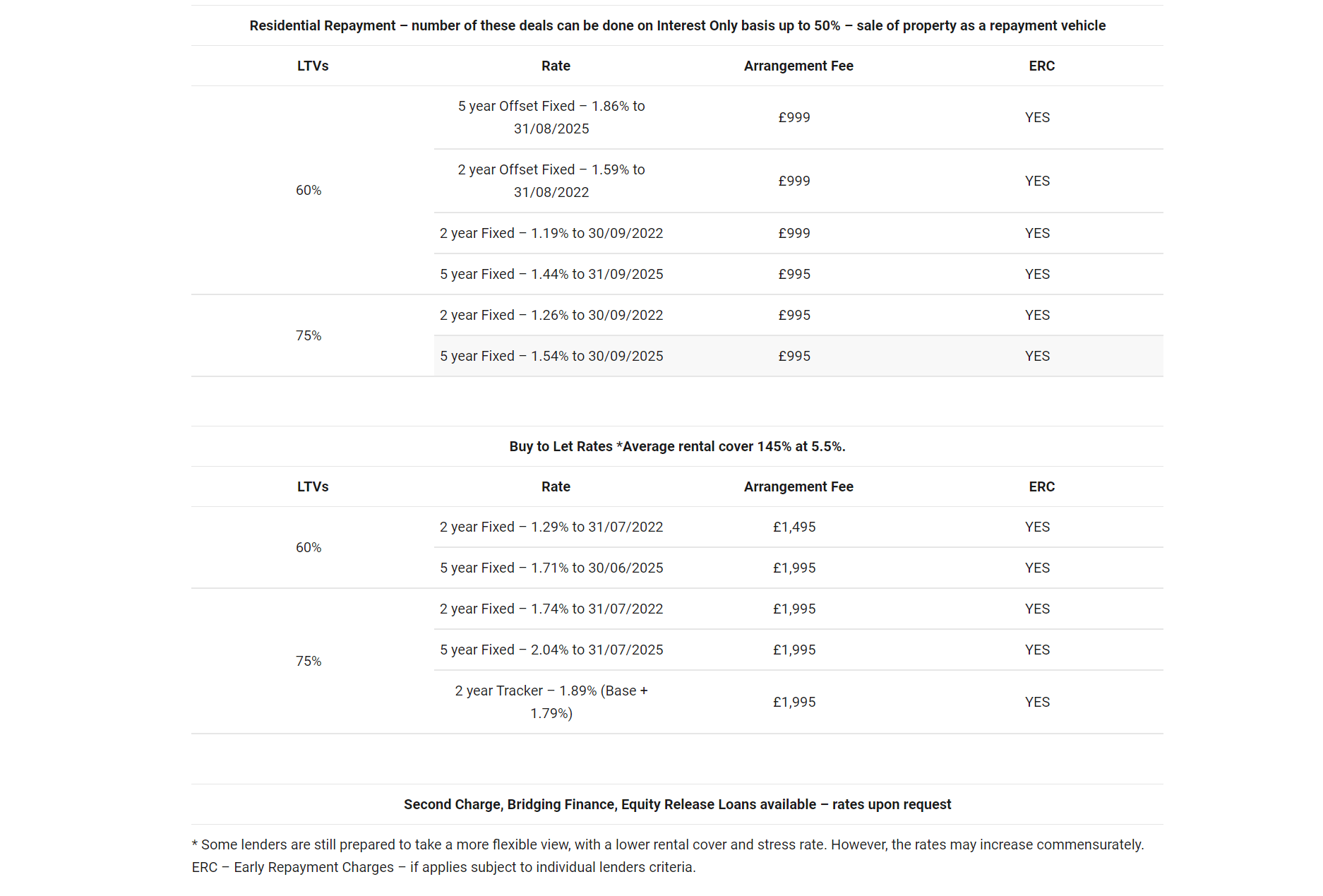

| Residential Repayment – number of these deals can be done on Interest Only basis up to 50% – sale of property as a repayment vehicle | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 5 year Offset Fixed – 1.86% to 31/08/2025 | £999 | YES |

| 2 year Offset Fixed – 1.59% to 31/08/2022 | £999 | YES | |

| 2 year Fixed – 1.19% to 30/09/2022 | £999 | YES | |

| 5 year Fixed – 1.44% to 31/09/2025 | £995 | YES | |

| 75% | 2 year Fixed – 1.26% to 30/09/2022 | £995 | YES |

| 5 year Fixed – 1.54% to 30/09/2025 | £995 | YES | |

| Buy to Let Rates *Average rental cover 145% at 5.5%. | |||

|---|---|---|---|

| LTVs | Rate | Arrangement Fee | ERC |

| 60% | 2 year Fixed – 1.29% to 31/07/2022 | £1,495 | YES |

| 5 year Fixed – 1.71% to 30/06/2025 | £1,995 | YES | |

| 75% | 2 year Fixed – 1.74% to 31/07/2022 | £1,995 | YES |

| 5 year Fixed – 2.04% to 31/07/2025 | £1,995 | YES | |

| 2 year Tracker – 1.89% (Base + 1.79%) | £1,995 | YES | |

| Second Charge, Bridging Finance, Equity Release Loans available – rates upon request |

|---|

* Some lenders are still prepared to take a more flexible view, with a lower rental cover and stress rate. However, the rates may increase commensurately.

ERC – Early Repayment Charges – if applies subject to individual lenders criteria.