Pensions for many are one of the most efficient savings structures, offering:

- tax relief on contributions;

- tax free accumulation of income and gains; and

- a tax-free pension commencement lump sum.

Additionally, since the introduction of pension freedoms in 2015, your pension is normally free of Inheritance Tax (IHT), unlike many other investments. Keeping your pension fund and passing it down to future generations can be very tax-efficient estate planning.

However, when contributing to your pension, it is important to be mindful of two key allowances: the Lifetime Allowance and the Annual Allowance. Updated multiple times since originally introduced in 2006, the combination of these two allowances could be the difference between pension contributions being the most tax efficient saving available or you being subject, at worst, to double taxation.

Annual Allowance

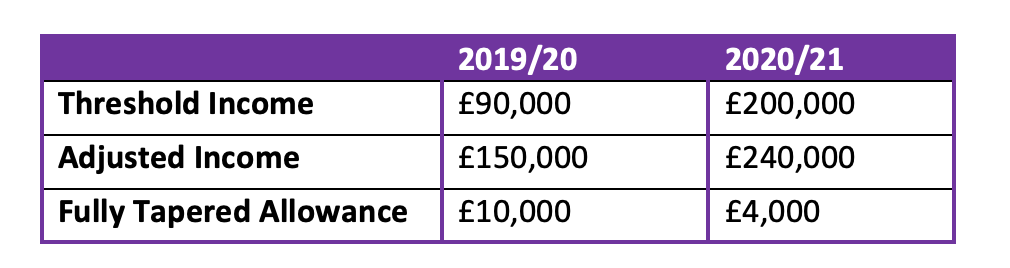

The Annual Allowance is simply the maximum that you can pay into your pension in a tax year. The maximum allowance has been £40,000 since 2014/15. However, since 2016, tapering has reduced the allowance for individuals so that if your income is over a certain level your Annual Allowance is reduced.

Just as many might have got to grips with this tapering; the rules have changed for 2020/21. These changes mean that many individuals whose Annual Allowance had reduced to as low as £10,000 are seeing an increase in the tax efficient contributions they can make, up to as much as £40,000 in some cases. There is a downside and, for the individuals subject to the most tapering the allowance could now be tapered down to as little as just £4,000 – the same level as the Money Purchases Annual Allowance. This is the amount that can be paid in one year to your money purchase arrangements without a tax charge applying.

Contributions above the allowance will not benefit from tax relief on the contribution, but may still be subject to income tax on withdrawals, currently up to 45% for additional rate tax payers.

Therefore, as we start the new tax year, it is important for all who make regular personal contributions or have received employer contributions to review their allowance to ensure they are optimising their pension efficiency.

The following chart sets out the income levels at which tapering comes into effect and the resultant allowance after maximum tapering has taken effect:

Remember: You can carry forward any unused allowance from the previous three tax years.

Lifetime Allowance

As you are probably aware, there is a maximum amount that can be taken from a pension scheme without being subject to a tax charge. This is called the Lifetime Allowance and if you take more than the maximum amount the tax charge is called the Lifetime Allowance Charge.

Initially set at £1.5m in 2006, the Lifetime Allowance peaked at £1.8m in 2010/11 and 2011/12 before subsequent reductions brought the allowance down to just £1m for those without protection. Now, this allowance increases each year in line with inflation and for 2020/21 stands at £1,073,100.

The Lifetime Allowance is not just related to the contributions paid into an individual’s pension but also the growth in value until the relevant crystallisation of benefits. Therefore, in considering if you might exceed the allowance, future growth needs to be estimated and factored into your calculations.

If the total of an individual’s pensions surpasses the Lifetime Allowance, the excess in value will be subject to one of two charges depending on how the benefit is taken:

- Excess charge of 25% if the benefit is then taken as income (with income tax also applicable).

- Excess charge of 55% if the benefit is taken as a one off lump sum (with no income tax charge).

As you can see from what has been summarised here, without careful review of how your pension contributions fit with the allowances and your pension’s place with your overall financial plan, making unconsidered pension contributions may be a costly mistake.

To review your pension contributions and your personal financial plan, please get in touch with your Partners Wealth Management adviser. Alternatively, please contact us via our central email and telephone on info@partnerswealthmanagement.co.uk or 020 7444 4030.

The contents of the article have been prepared solely for information purposes. The article contains information on financial products and services and such information is designed for and addressed solely to individuals seeking generic industry information.