Whether you are just starting your career or approaching retirement, it is never too early to plan for the next chapter. For many, the complexity of pension rules and competing financial priorities can make planning for retirement feel daunting. At Partners Wealth Management, we believe there are a number of simple steps you can take now, allowing you to retire with confidence.

Our clients are empowered with a comprehensive understanding of their financial situation, a tailored planning strategy, and the specialist expertise required for achieving their ideal retirement. To get started on your retirement strategy, take our interactive quiz and use our comprehensive checklist. These tools will guide you through the steps needed to reach your desired retirement lifestyle, empowering you with a clearer understanding of what you need to do.

When it comes to our retirement plans, the step away from the stability of a regular income and into the unknown can be challenging. Research commissioned by 7IM shows that not having enough for retirement is a leading concern for over half of retirees. This is understandable as planning and saving for retirement requires discipline and hard work – we want to ensure you have enough money to achieve your retirement dreams. We will create your bespoke Lifetime Wealth Model that provides real insight, giving you and your family a strong foundation to make planning decisions to shape the next chapter, whatever that may be.

There is no ‘one-size-fits-all’ retirement. Everybody has different goals and aspirations, requiring a tailored approach to financial planning.

You might wish to use your retirement to pursue a new hobby, achieve your dream of travelling the world, or support your family. Whatever your aims, your PWM adviser will provide you with a bespoke financial plan that will give you freedom and flexibility,

We believe that retirement is a team effort. This is backed up by recent research demonstrating that individuals who join forces with a financial adviser expect to retire earlier and with a larger pension pot than those who attempt to go it alone.

We are always your first point of contact for anything financial. Whether we can assist in-house or through our Private Office of trusted partners, we introduce you to specialists who will form a holistic team to address every aspect of your retirement planning needs.

With Partners Wealth Management, you’ll have a professional adviser with you every step of the way on your retirement journey – from setting your goals to delivering and reviewing your financial plan.

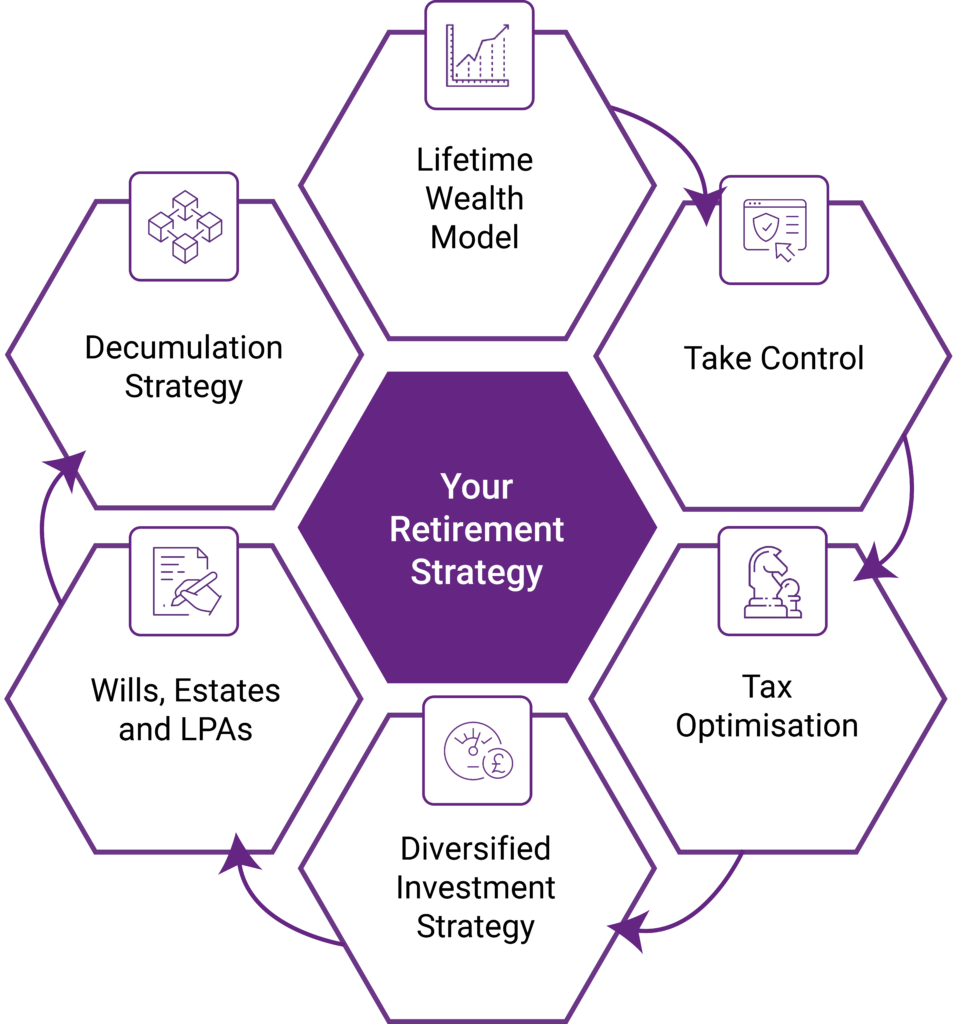

Our Retirement Strategy diagram demonstrates some of the key steps in that journey. Below, we have outlined how the six steps of the process will help you move forwards on the road to becoming retirement ready.

Using sophisticated cashflow modelling software, we can use current information about your financial situation to map out what your future might look like, delivering an accurate picture of exactly where you are on the path to achieving your goals.

With the data we take from your Lifetime Wealth Model, we can help you take control of your retirement by putting a comprehensive plan in place to take you from where you currently are, to where you would like to be.

Your adviser will leverage their expertise to ensure your plan is as tax efficient as possible, from using all your available tax efficient allowances to exploring the possibility of tax-efficient investment structures such as the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs).

We will review your investment portfolio to ensure it is sufficiently diversified across a range of asset classes, giving your investments as much protection as possible against stock market volatility.

An often-overlooked part of retirement planning is considering what will happen to your pension and other assets on your death. We can put you in touch with trusted legal professionals who will support you in setting up a Will, Lasting Power of Attorney and other documentation designed to ensure your assets are passed on to the next generation as tax efficiently as possible.

Once you reach retirement, we will develop a solid decumulation strategy designed to draw down your retirement savings in the most efficient manner possible, ensuring they last as long as you need them to.

We believe it’s important to start your retirement strategy early. We like to think that retirement isn’t an ending but part of a journey where your adviser will be with you at every stage to help you to shape your ideal retirement. It’s your journey to financial independence; having an experienced adviser in your corner will help ensure you feel more in control of that journey and more able to adapt to the challenges life throws at you along the way.

To find out what ‘retirement ready’ looks like for you, please call 020 7444 4030 or email info@partnerswealthmanagement.co.uk for an initial meeting, which is without charge or obligation.

For further information on how we can help you build and protect your wealth, please contact us.