President Trump has announced there will be a pause in tariffs to every country except China. Key trading partners from Vietnam to the EU have seen their tariffs come down from 46% and 20%, respectively, to a blanket 10% across the board. Even Lesotho received a reprieve coming down from 50%.

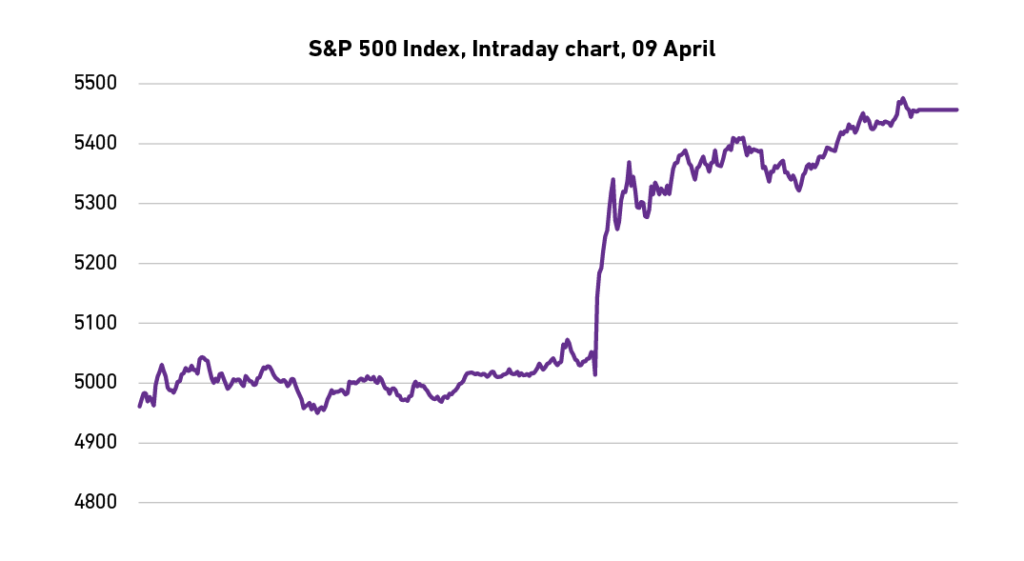

The impact the on the US equity market was a 9.5% move up on Thursday. It was one of the biggest one-day moves ever and leaves the US stock market less than 4% down from its level on 2 April when the tariffs were first announced. As we write, the Asian and European markets are following suit. Even still, market volatility remains elevated and investors remain nervous.

Source: 7IM, Bloomberg. Past performance is not a guide to future returns.

The news outlets have been filled with updates about the global stock market gyrations. ‘X Billions wiped off the stock markets value’. Words designed to capture attention, like ‘chaos’, ‘disorder’ and ‘crisis’ fill the airwaves with every move. But is any of this helpful for investors?

Short-term news can be distracting for long-term investors. If there was ever a week to reaffirm this, it was this week. There will continue to be plenty of news stories, sometimes real, sometimes fake, over the coming weeks. We might hear about new tariffs and counter tariffs. We’ll hear about digging in heels and climb downs. We’ll hear about successful negotiations and walking away from the table. All of this will move markets in the short-term. Market volatility will be the talking point. Clients will be tempted to divest based on what they hear in the news.

It’s because the news gives the impression that investors are beholden to the random movements or at the mercy of big global players. Instead, we have to remember that fundamentals matter more over the longer term. Academic research finds that, time and again, despite the short-term noise, markets find a way back to the fundamentals over the longer term.

A key reason is that companies earn profits. To entice investors to hold their stocks, these companies offer investors a slice of the pie. More specifically, a return in the form of a dividend (or an offer to buy-back shares – another way to return profits back to shareholders).

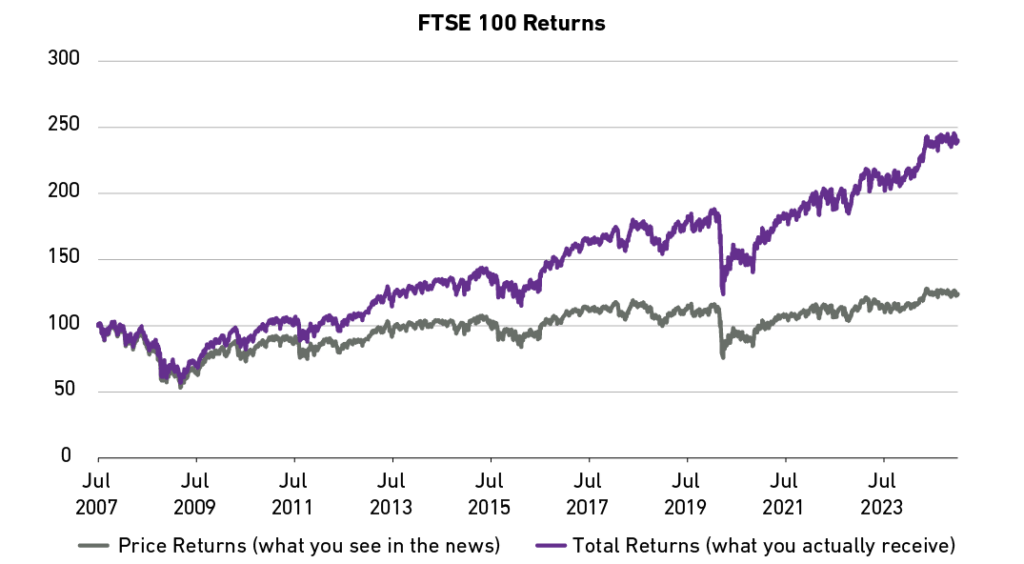

Take the FTSE 100, a market of large companies listed in the UK. We’re talking AstraZeneca, HSBC and BP. Put together, it has a dividend yield of over 4%. While the dividend yield is not as certain as, say, the yield on a UK government bond, it has a history of being fairly stable.

The impact of dividends is that, since 2007 (the peak of the market before the financial crisis) about 80% of the market’s returns have come from the dividends (see chart below). This includes a banking crisis, the Eurozone crisis, Brexit and a global pandemic. All through this, returns were being made to shareholders. However, the news only talks about the price return (just 20% of the total return in this period). Listening to the news can seriously impact your financial health.

Source: 7IM, Bloomberg. Past performance is not a guide to future returns.

It’s important to remember that this is not just for equities. Multi-Asset portfolios will also own government bonds with steady coupons, yields for lending to companies, while the diversifying alternatives basket will pass through cash returns.

Put together, the news flow about the tariff wars and other distractions will keep coming. Through all the ‘turmoil’, it’s important to remember that our clients hold portfolios designed to make returns, through dividends and coupons, even if price returns are challenging in the short-term. Diversification is a time-tested way to see through periods of uncertainty for clients with a long-term focus. This time will be no different.

We will continue to monitor portfolios and navigate through the short-term volatility. While we remain focused on the long-term, we will adjust portfolio as required – for instance we are actively looking at rebalancing portfolios when the opportunity presents itself, something that is accretive to long-term gains. As ever, we will continue to keep you informed of the outlook, provide any support you need and update on any portfolio changes.

As usual, we will keep a close eye on developments likely to impact your personal finances. We cannot foresee what will happen over the next few months and this isn’t an exhaustive list of possibilities, but looking after your financial future remains our priority and we are available to review such matters with you, as necessary.

The past performance of investments is not a guide to future performance. The value of investments can go down as well as up and you may get back less than you originally invested. Any reference to specific investments is included for information purposes only and are not intended to provide stock recommendation or investment recommendations to individual investors.