Following Trump’s tariff announcement last Wednesday, US equities finished last week with their worst two-day performance since the Covid-19 sell-off in 2020, the dollar fell and energy commodities like oil were down around 13%. Although markets globally were not immune, US asset markets were the hardest hit.

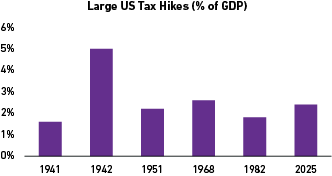

At its core, tariffs are a tax on consumers, which, if passed on by importers, will represent the largest tax increase on US households and business since the Revenue Act of 1968, which preceded the 1969-70 recession.

Source: 7IM, Tax Foundation, JP Morgan

Now even if this does convince big companies to move production to the US (JCB have already announced a doubling in size of their new Texas factory) that doesn’t necessarily spell good times for US equity markets. After all, jobs in construction in the southern US aren’t what US markets have built their performance on over the past decade – tech has been front and centre there. Not only will any possible American winners from tariffs be unlikely to be based in San Francisco, there’s also the problem of retaliation. The big tech companies are a huge target for Europe or Asia to aim at – and governments have been looking for an excuse for a while.

Following the initial market reaction on Thursday, a key driver of the further move down on Friday was China announcing an increase of tariff rate on all US imports by 34%. Chinese and Hong Kong markets were closed on Friday and so part of the movement this morning is a case of “catch up” from the week before.

When shocks like this hit the system, it can be difficult to accurately predict their effects. IMF model estimates a 20% US tariff hike, with retaliation from China and the Euro zone, which could reduce US GDP by 2% and global GDP by 1%. Tariffs can lead to inflation globally, but it is likely the impact on the US will be even more pronounced given the effect on the dollar; a depreciating currency increases the costs of imports even before retaliatory action. Much of the dollar weakening is due to the expectation that the Federal Reserve will step-in and bring forward any cut in rates to support the economy, with lower interest rates making the dollar less attractive. The longer-term inflation story is less clear, as lower growth reduces the longer-term inflationary impact of the tariffs.

Regardless of the eventual outcome from negotiations/trade conflict, it’s this uncertainty which will itself be a drag on economic growth around the world. While it’s unlikely to be as painful for the global economy as Covid-19, or the 2008 Financial Crisis, tariffs knock confidence.

When responding to news, a data-driven approach to decision-making seems like the most sensible approach. There will no doubt be continued uncertainty on what Trump will or won’t reverse when it comes to tariffs, as well as how others will react. Instead of trying to predict any actions here, we and our selected investment managers will continue to monitor the impact on the data, shifting positioning accordingly, safe in the knowledge our starting point for portfolios emphasises diversification. Process-driven actions like rebalancing will ensure our client portfolios factor in appropriately the latest thinking and developments.

When investing, the importance of sound advice and regular portfolio reviews remain constant. Having these pillars in place will not only ensure that your investments are aligned to your goals and risk tolerance but will also pave the way for a robust investment strategy tailored to your personal needs. We believe this approach will always bring clarity to your financial journey. In building your portfolio and wealth, we draw valuable lessons from times when unexpected events take place.

We will continue to monitor markets and provide suitable strategies and financial plans to support your long-term needs and objectives. These can, of course, be adjusted to changing circumstances.

We cannot foresee what will happen over the next few days, weeks or months, but looking after your financial future remains our priority and we are available to review such matters with you, as necessary. Please do contact your adviser if you have any questions – we’d be delighted to assist.

The past performance of investments is not a guide to future performance. The value of investments can go down as well as up and you may get back less than you originally invested. Any reference to specific investments is included for information purposes only and are not intended to provide stock recommendation or investment recommendations to individual investors.